India’s transition to solar power is more than just a future ambition; it’s an exciting reality that’s already unfolding. By 2025, as nations across the globe ramp up their energy transition efforts, India’s solar sector is expected to penetrate deeper into the market landscape, propelled by significant technological advancements and a growing momentum within the industry.

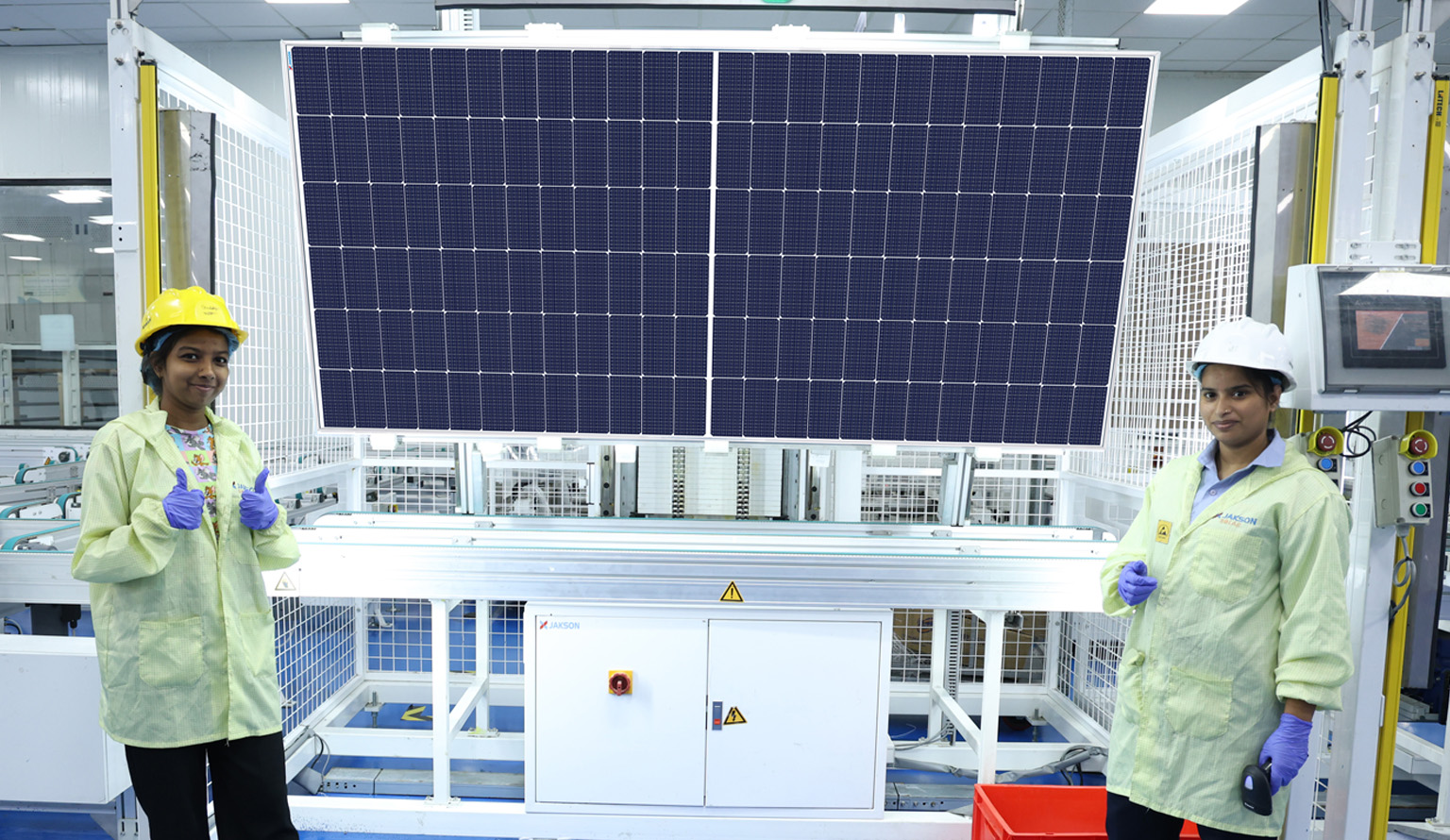

Brands like Jakson, a key player in this dynamic landscape, offer a diverse range of high-quality solar modules and cells that are integral to this movement. Their products stand out not just for their reliability but also for their innovative design, which promises enhanced efficiency and performance.

We will examine critical factors such as the different types of solar modules available, the strategic approaches to manufacturing that are being adopted, and the dynamics of deployment in various regions. This comprehensive analysis will provide invaluable perspectives for market stakeholders who are keen to navigate the evolving landscape of solar energy innovation India.

Why 2025 Matters in India’s Solar Energy Landscape?

As we look ahead to 2025, it’s clear that India is on the brink of a solar energy revolution. The country has made impressive strides in solar module manufacturing and deployment, with companies like Jakson leading the charge. For example, Jakson’s modern facility in Greater Noida boasts an annual production capacity of 1.2 GW of solar modules. This capability places Jakson at the forefront of solar manufacturing India, which is vital for the country’s growing energy demands.

Key Trends Shaping the Future of Solar Power India

1. Advancements in Performance & Efficiency:

Jakson’s Helia series of solar modules, built with A+ category half-cut MonoPERC cells, boasts efficiencies exceeding 21%. These modules are designed to perform well even in high temperatures and low-light conditions, indicating that in 2025, higher-efficiency modules will become standard rather than just premium options.

2. Increase in Bifacial & Dual-Sided Module Adoption:

Jakson’s Helia Plus Biofuels Solar PV Modules are designed to harvest “up to 25% additional power” from the rear side. With versions tailored for both utility-scale solar projects and rooftop solar India applications, we can expect bifacial technology to play a significant role in maximising energy yield across various installations by 2025.

3. The Rise of TOPCon & N-Type Modules:

Jakson’s Helia NXT – TOPCon modules offer impressive efficiencies up to 23.25% and a bifaciality factor of around 80%. These premium modules, backed by extended warranties, are particularly suitable for long-term projects, aligning with the growing demand for sustainable energy solutions in India.

4. Focus on Solar Manufacturing and Domestic Value:

Jakson aims to enhance local manufacturing capabilities, which is crucial for reducing import dependencies and controlling costs. Their strategy involves not only producing solar modules but also moving into solar cell manufacturing as part of a broader vision for solar energy innovation India.

Market Dynamics for 2025

- Utility-scale and Ground-mounted Solar: Expect a heavy emphasis on bifacial modules to maximise land use efficiency.

- Rooftop Solar India: Rooftop installations may increasingly opt for bifacial variants with a transparent backsheet to blend aesthetics with functionality.

- Long-durability Projects: For developers looking to establish long-term power purchase agreements, TOPCon modules will justify the higher upfront costs through lower degradation rates and robust warranties.

- Domestic Procurement Policies: Given the importance of solar energy policies India, government incentives favouring locally manufactured modules will benefit companies like Jakson.

Challenges and Strategic Enablers

Challenges:

- High capital costs for advanced technologies like TOPCon may deter some developers from taking risks.

- Maintaining consistent quality during large-scale production is critical; Jakson emphasises the use of Tier-1 BOM and certified components.

- Meeting performance claims in real-world conditions, particularly concerning temperature, dust, and shading effects, remains a test.

Strategic Enablers:

- Continued research and development in photovoltaic (PV) technology India will be essential to drive innovation in solar energy.

- Aligning with the National Solar Mission 2025 will help provide the necessary policy framework to support India’s solar ambitions.

Final Thoughts

By 2025, India’s solar energy sector is expected to undergo a significant transformation, shifting from traditional technologies to more advanced module solutions, including bifacial and TOPCon technologies. Jakson is strategically positioning itself to be a key player across this evolving landscape with its Helia, Helia Plus, and Helia NXT product lines. With a manufacturing capacity of 1.2 GW in Greater Noida and a focus on cell production, brands like Jakson are well-prepared to compete in an era that demands higher efficiency and greater reliability.

The dynamics of deployment will favour companies that can combine high-output modules with effective cost management and quality assurance. As module efficiency becomes increasingly crucial for project viability, organisations like Jakson will play a vital role in propelling India’s solar energy growth. The year 2025 may mark the point at which solar energy transitions from being a supplementary source to becoming a foundational element of India’s energy infrastructure.